GST 2.0 simplifies India’s tax slabs to 5% & 18%. Find out what gets cheaper in 2025 — cars, TVs, insurance, food, and more.

Imagine buying a small car, a washing machine, or even your favorite fruit juice… and paying a lot less GST than before. Sounds exciting? That’s exactly what’s happening with GST 2.0 in India.

From September 2025, India’s indirect tax system will undergo its biggest upgrade since 2017. This time, the focus is on lower GST rates, simpler structure, and cheaper daily essentials. Let’s break down GST 1.0 vs GST 2.0, highlight the new GST rates 2025, and explain exactly what items are cheaper now.

GST 1.0 vs GST 2.0: Key Differences

When GST 1.0 was introduced in 2017, it promised One Nation, One Tax. But it came with four slabs (5%, 12%, 18%, 28%) plus cesses — leading to confusion.

- Businesses faced blocked input tax credits and inverted duty structures.

- Consumers weren’t sure if benefits of GST cuts were passed on.

- MSMEs struggled with compliance.

GST 2.0 fixes this.

- Simplified two-tier structure: 5% and 18%

- 40% sin tax for luxury goods (SUVs, cigarettes, etc.)

This streamlined system is easier for businesses and friendlier for consumers.

GST 2.0 New Rates 2025 – What Gets Cheaper?

Here’s a complete list of categories that benefit under GST 2.0:

Automobiles

- Small Cars: 28–31% ➝ 18%

- Tractors: 12% ➝ 5%

- SUVs: 50%+ ➝ 40% sin tax

Consumer Durables

- Air Conditioners, TVs (above 32”), Dishwashers: 28% ➝ 18%

Housing & Construction

- Cement: 28% ➝ 18%

(Cheaper building costs, though coal levies may offset a bit.)

Food & Beverages

- Packaged Foods (biscuits, noodles, bakery): 18% ➝ 5%

- Fruit Juices: 12% ➝ 5%

- Water & Soda: 18% ➝ 5%

Personal Care

- Soaps, Shampoos, Hair Oils: 18% ➝ 5%

Hospitality & Travel

- Hotels under ₹7,500/night: 12% ➝ 5%

Insurance

- Retail Health & Life Insurance: Exempt from GST

Retail Shopping

- Footwear under ₹2,500: 12–18% ➝ 5%

- Clothes ₹1,000–₹2,500: 12% ➝ 5%

Renewable Energy

- Solar Cells: 12% ➝ 5%

In short: from groceries to cars to insurance — GST 2.0 makes life cheaper.

In short: from groceries to cars to insurance — GST 2.0 makes life cheaper.

The Bigger Impact of GST 2.0

GST 2.0 isn’t only about cheaper products. It addresses long-standing business issues:

- Inverted duty structures fixed (e.g., textiles, fertilizers).

- Faster refunds for MSMEs through simplified input tax credits.

- Ease of doing business improves, boosting MSME confidence.

The government estimates a revenue loss of ₹48,000 crore, but expects consumption-led growth to balance the impact.

Winners and Losers Under GST 2.0

Winners: Automobiles, consumer durables, food, retail, hotels, insurance, renewables.

Winners: Automobiles, consumer durables, food, retail, hotels, insurance, renewables. Mixed Impact: Cement (positive if coal cess adjustments come through).

Mixed Impact: Cement (positive if coal cess adjustments come through). Losers: Cigarettes, luxury SUVs, premium apparel — all taxed under the 40% sin category.

Losers: Cigarettes, luxury SUVs, premium apparel — all taxed under the 40% sin category.

For the average Indian household, however, the basket of essentials and aspirational goods is getting cheaper.

Conclusion: GST 2.0 is the Upgrade India Needed

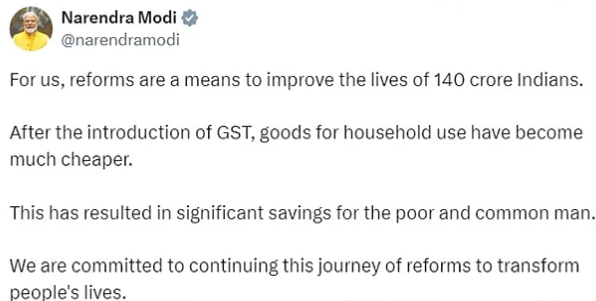

GST 1.0 was a revolution. But GST 2.0 is the upgrade that finally simplifies the system and benefits everyday Indians.

- Lower GST on daily essentials

- Affordable consumer goods and cars

- Cheaper insurance premiums

- Boost for MSMEs and green energy

The big question is: Will GST 2.0 reduce your monthly expenses?

Tell us in the comments below!

And don’t forget — follow and subscribe to stay updated with financial news that saves you money.

For such great insights, do watch our videos on https://www.youtube.com/@Hargharcrore